Wednesday, September 30, 2015

No More Silos

There's one glaring and obvious conclusion to be reached from the Workers' Compensation Research Institute's latest study finding a great likelihood of case shifting out of group health onto workers' compensation - the silos that have been created throughout the years of various health care systems need to be consolidated into a single system regardless of fault, causation, or jurisdiction.

The only qualifying measure should be employment.

Some may call this universal care, 24 hour care, socialism, whatever - it's the only thing that makes sense.

The reason is that financial incentives definitely influence provider behavior. We have known that for years. It is not a mystery - in fact it completely makes sense and is in line with what behaviorists would expect.

Yes, there are legal issues and practical considerations - these have all been argued and debated for years.

None of those reasons or objections can't be engineered out or at least ameliorated.

The primary reasons why any shifting would occur are two-fold and the first and most important consideration is that it is the primary treating physician who first sees the patient who is going to ask the probing, leading questions, that will determine how an injury or illness "occurred" - i.e. causation.

"The amount of uncertainty about the cause of the medical condition provides the opportunity for the financial incentives to influence the decision," the study summary states.

The second, and perhaps no less important consideration, is that group health plans are moving more towards capitated reimbursement systems, following the Affordable Care Act model, whereas workers' compensation is, by and large, still fee for service. The WCRI theory is that providers would rather be paid by service because they can make more money.

So the obvious answer would be to convert workers' compensation to capitated plans - but doing so runs afoul of workers' compensation's primary medical promise: treatment for life; ergo, a capitated plan in workers' compensation would alienate more providers than even low fee schedules.

Thus, the only way to combat any cost shifting is to align the medical incentives, and the only way to reasonably accomplish that is to have one medical system - not the panoply of systems that now create a dizzying array of complexity certain only to increase costs and diminish outcomes.

There have been attempts in the past on a state basis to implement some type of "24 hour" coverage or other universal plans and they have mostly been defeated or marginalized by all of the conflicting interests.

Yet, if medical care, including workers' compensation, is to escape the current dysfunction of competing financial incentives, the only avenue is to eliminate the competing incentives.

As long as there are silos of opportunity, the best silo will get the business, and the burden. And it's all the same - the cost shakes down to the consumer at some level anyhow.

Tuesday, September 29, 2015

Don't Look At Me

Calling it "one of the largest insurance fraud scams in California history," the Los Angeles Times yesterday reported on the release of the grand jury indictment transcript made public Friday.

The story highlights some of the grizzly details of botched surgery, 21 victims coming forth with nearly unbelievable tales of a greedy physician run amok within the California system.

Dr. Munir Uwaydah is allegedly the mastermind behind all of the criminal activity - from medical misdeeds to kickbacks, payola, extortion and even murder.

The story highlights some of the grizzly details of botched surgery, 21 victims coming forth with nearly unbelievable tales of a greedy physician run amok within the California system.

Dr. Munir Uwaydah is allegedly the mastermind behind all of the criminal activity - from medical misdeeds to kickbacks, payola, extortion and even murder.

Uwaydah is just one small example of a workers' compensation system out of control with illegal, fraudulent behavior.

|

| "Don't look at me... EYE didn't do it!" |

There is also the State Compensation Insurance Fund lawsuits naming virtually every applicant oriented household name we've all come to recognize of the past couple of decades: names like Drobot, Capen, Sobol, Landmark, Rosen, Hunt, Larsen, etc. ad nauseum.

Most of the industry thinks all of this is just terrific - big names, big time fraudsters, criminals are getting their just rewards and the system is ridding itself of millions of dollars of cheating so more money can get to where its supposed to go.

But wait a minute - should we be so congratulatory? I mean, why NOW, after somewhere between 20 and 30 years, are we NOW so pleased that criminals are being rooted out and forced to come to terms with their malfeasance? Why didn't this happen earlier? Why did we need to incur millions of dollars in damage, and dozens of lives put at risk, to finally do something about purported misdeeds?

Let me put it bluntly - we are a pathetic group of complicit non-doers either afraid to challenge malfeasance, or simply not interested because "it's somebody else's job."

I have had people come to me through out the years with tales of wrong doing by all of these same folks that are named in the indictments and lawsuits, but nobody was willing to give details, name names, provide documentation or testimony.

Law enforcement can't do its job unless it has evidence. District attorneys won't take a case unless they can prove criminal activity, and again, without names, details and documentation, nothing will get done.

The State Fund suit alleges criminal activity dating back to the mid-2000s, over ten years ago, and that damages incurred total tens of millions, if not hundreds of millions, of dollars as a result of these alleged schemes.

But why was State Fund so complicit in the beginning? Why weren't the patterns of wrongful behavior detected earlier, and contested earlier? Why did State Fund spend millions of dollars feeding the conspiratorial actions of the defendants before figuring it out?

And truth is, State Fund didn't really incur the damage - they were just a conduit. All of the damage that State Fund alleges is really damage its policyholders incurred. In reality, State Fund just passes the experience buck down the food chain.

Oh, and don't think for a minute that this particular routing of fraudulent and criminal vendors will stop any activity. I had earlier blogged, as has Joe Paduda, about internal fraud and misdeeds that goes unexposed and unpunished, all because this industry tolerates anonymity to protect the innocent.

I'm not criticizing the current routing of criminals out of the system. On the contrary, it's about time and I hope it sends a message.

But I suspect that the real message being sent to the narcissistic anti-socials perpetrating large scale work comp crime is just to be more careful, because people are loath to blow the whistle.

To quote cartoon character Bart Simpson, "Don't look at me! I didn't do it, nobody saw me do it, can't prove a thing."

Right...

Monday, September 28, 2015

A Sharp Point

Minimum wage, living wage, tax reform, health and medicine - you name the financial topic and arguments break out about the widening gulf between the poor and the wealthy to such an extent that many are saying that the middle class is in jeopardy of being marginalized, if not out right extinguished.

Charles Moore, in the Saturday Essay of the Wall Street Journal, opines that the middle class is trending towards a "have-less", though not quite yet a "have-not", status.

"When things go backward in nations accustomed to middle-class stability, people start to ask questions," Moore writes. "What is the use of capitalism if its rewards go to the few and its risks are dumped on the many? The rights of property do not seem so enticing if the value of what you own collapses or if that property is trapped by debt. What is so great about globalization if it means that the products and services you offer are undercut by foreign competition and that millions of new people can come to your country, take your jobs and enjoy your welfare benefits?"

And we have started in the past decade to ask these same type of questions about workers' compensation.

What is so great about a no fault system of injury protection when you have to go to court to prove that an injury was not your fault (co-morbidities, psychological status, drug or alcohol use, cancer, etc.)?

What is so great about spreading the risk when the cost of spreading that risk causes business to question the value of such?

"The owner of capital decides where money goes, whereas the people who sell only their labor lack that power, " observes Moore. "This makes it hard for society to be shaped in their interests. In recent years, that disproportion has reached destructive levels, so if we don’t want to be a Marxist society, we need to put it right."

As recent studies and publications have explored, there is great disproportion between states as to benefits in workers' compensation.

But more than that, there is good evidence that there has been an increasing disproportion between wages, maximum benefit levels and the financial destruction to a wage earner's future.

Workers' compensation has been around for over 100 years in the United States. And since 1948, every state and federal agency has had a workers' compensation system. Other than in Texas, work comp is compulsory, and essentially has become a "right" unto The People. In fact, most states have workers' compensation embedded into their state constitutions.

Each state controls their own work comp system. They make it, tweak it, and regulate it based on the local social norms, which is why some states are more expensive than others, and why some states are less expensive than others. And why some states provide more benefits than other states, and some are more or less efficient than others.

Workers' compensation has essentially become a "states rights" program - just mention federalization of workers' compensation and you will see the passion flow, and more often than not a "hell no!" exclamation from the vast majority.

Here's the friction: workers' compensation is a right unto The People. That right has evolved over 100 years. Even in Texas, when workers' compensation is invoked, it is not just a benefit, but a right - the worker hurt doing his job is ENTITLED to compensation. In fact, work comp is much more of a right unto the people than even health care...

And when I say "compensation" in this context, I'm not just talking about indemnity, but also provision of medical benefits.

Disparity in compensation among the states has drawn public attention. And when enough public attention gets drawn to an issue that affects a big proportion of the population, government takes notice.

What DOES matter is the widening gap between have, and have not. Class divide. Socio-economic disparity.

When socio-economic disparity reaches intolerable levels, revolution occurs.

Throughout history, when the divide between the rich and the poor got too large, either the government took steps to redistribute the wealth or there was revolution and 'blood in the streets'. If you don't believe that you might want to check with Tsar Nicholas, Louis XVI, or Marie Antoinette.

The Federal Government made a massive wealth grab in 1913 with Income Taxes, going off the gold reserve, and setting up the Federal Reserve Board of Governors. Most of that was done under the influence of Teddy Roosevelt (who is also credited as a leading progenitor of work comp). In 1935, Congress passed the Social Security Act under Franklin Roosevelt. The Social Security Act of 1965 established Medicare and Medicaid under Lyndon Johnson with his Great Society and War on Poverty. They were all government controlled wealth transfers - from the rich to the poor.

"Labor is prior to and independent of capital," wrote Abraham Lincoln. "Capital is only the fruit of labor, and could never have existed if labor had not first existed. Labor is the superior of capital, and deserves much the higher consideration." Abraham Lincoln wasn't against slavery simply because it was a human rights abuse so much as it was unfair competition...

Yet, in workers' compensation it's capital that comes first. Those that influence and make our workers' compensation laws have forgotten that without labor, workers' compensation would not be needed at all.

So, will the federal government step in and take over work comp, federalizing a states' rights program?

I don't see it, at least not in our current political environment. Good luck getting four people in Congress to vote for that. Right now Congress is so dysfunctional that their only aim is to make sure that whatever the other party wants to do, gets defeated - even if it is a bill to 'Pull Grandma out from under the bus.' It's not one-sided; the Democrats and Republicans share the blame equally. And no Senator or Representative will ever vote for legislation that curbs States Rights.

But the United States Supreme Court has no problem dictating States Rights. And it has weighed in on workers' compensation before, addressing its constitutionality, and they can do it again.

The Commerce Clause of the United States Constitution (Article I, Section 8, Clause 3) gives Congress, and by extension, the Supreme Court, basically full rein to do whatever they want.

The 14th Amendment (Equal Protection under The Law) puts the nail in the coffin. That gives the Supreme Court nearly unfettered power to legislate from the bench. And the Supreme Court has no problem doing so, its recent rulings on same sex marriage and the Affordable Care Act being the most current examples.

So, it is not a stretch of the imagination to see the Supreme Court invoke the Commerce Clause and the 14th Amendment to enforce a system where everyone gets equal access to work comp with equal benefits. Such action will be provoked by a sensitivity that there is an unacceptable declination in the Middle Class, that the gulf between haves, and have-nots, is too wide, as exemplified by the great disparity in benefits between states given the same or similarly situated injured worker.

Workers' compensation tends to live in its own shell, but we tend to forget that it is a microcosm of society - what happens in work comp is happening in the rest of the world. Work comp is just a focal point.

Albeit, a sharp point.

Friday, September 25, 2015

The Private Loss

The tune changes when different hats get worn.

"I now understand what they feel like," Jane Hays is quoted as saying in a Texas Tribune article the other day. "We just need to have a workers' comp system that is fair to the workers, the injured workers."

"In a case with serious and disputed legal issues," Randal Beach, Executive Director of Texas Political Subdivisions, a non-profit self-insurance pool administering workers' compensation benefits for local government entities rebutted to Bob Wilson, "the only prudent course of action is to seek a determination from the system set up for that purpose."

Beach refers to Hays' injuries - the 73 year old member of the Board of Trustees of TPS who sustained serious injuries in a car accident returning from a board meeting. The meeting occurred over the course of three days at The Woodlands. Her regular employer, the Temple Independent School District, marked the reason for her absence as "SCHBUSINESS (DIST)," or school business, in computer logs.

She was returning home after the board concluded its last meeting on Saturday, July 11, at around noon. The accident occurred at approximately 1:30 p.m.

The injuries to her right lower extremity required amputation. Hays still faces multiple other surgeries for her injuries.

Hays was highlighted in the Tribune because even though she is an "insider" her claim was denied on the grounds that it did not arise out of or in the course of employment. TPS is claiming the "going and coming" rule excludes coverage.

The "going and coming" rule says that workers' compensation is inapplicable for injuries or claims incurred during the commute to and from work.

TPS says it wants to take the "safe road" because they have an obligation to members, the public and TPS' insurers and reinsurers, to make sure the law is followed.

Hays was a volunteer Director of TPS and is not paid for the job. Instead they paid for her travel, her lodging at the meeting and her meals.

As explained by Beach, "For these meetings, the pool reimburses trustees' expenses, since they are not otherwise compensated for serving on the Board. For workers' comp purposes, the trustees are considered 'employees' of the pool when they are attending Board meetings. When they travel to Board meetings they are traveling to their 'place of work'. The pool does not direct the method, route or schedule of their travel or where else they go on their way to work or on their way home."

But expenses related to the "commute" are reimbursed by TPS as noted above, and TPS directs where the meetings are held (different resorts are chosen - the meetings are not held at "home office").

In other words, TPS essentially controlled the who, what, where and when of "the job."

And Hays, for her part, provided benefit and service to TPS.

But TPS' three legal opinions differed, according to Beach.

"All agreed that to overcome the 'coming and going rule as applied by Texas courts," Beach wrote Wilson, "the claimant would have to establish that the meeting from which she was traveling home was a 'special mission'. One opinion stated that it was a 'special mission' because the meeting was not held at the home office. Another opinion held that the fact that the Board had chosen to hold this meeting at another location did not convert it from a regular meeting to a 'special mission', and therefore the 'coming and going' rule excluded coverage. The third opinion stated that because there were novel issues involved, including statutory differences in the treatment of public and private employees, and legal questions distinguishable from prior case law, the case could go either way. They recommended following the process established by law to determine whether coverage exists."

That's the problem I have with this case - LAWYERS advised going to court, abdicating responsibility so no one person at TPS has to own up to questions by other board members, the public, or, gasp, the underwriting insurance carriers and reinsurers who may be asked to chip in - this is an expensive claim for crying out loud!

Lawyers advising to let the courts decide is like an orthopedic surgeon advising to have surgery - hello!

In a system that is allegedly "no fault" there seems to be enough fault being thrown around to make that a laughable description.

Wilson replied to Beach, "your comments leave me little solace or assurance that the spirit of the Grand Bargain is alive and well. The problem with workers’ comp today on a broader scale is that we are only concerned with doing what is legal, and not that which is simply right."

Beach essentially admits that denials are standard operating procedure for the pool, telling the Tribune, "I have to treat it like another claim. It doesn't matter how much I love Jane, and I do."

If Hays were Beach's mother, I'm sure the outcome would be quite different.

I try to paint workers' compensation as a social benefit.

But cases like this put too much cynicism in the way, because those who are tasked with paying see it as a private loss.

Thursday, September 24, 2015

Angels in Blue

|

| NOT the crummy photo I shot from 41Mike! |

My brother, friends and I would "fly" on the swing set, as high as we could go in attempts to "loop" just like dog fighters, and we would make jet kind of noises, and "radio" calls to one another.

And of course then the F-14, Tom Cruise and Top Gun came out. I think I watched that movie a hundred times.

But the creme-de-la-creme was, of course, the Blue Angels - gawd did I want to be one of them, in their flight suits, steely reflective helmet shields, and deep blue F-18s. I would fantasize about huge, diamond formation loops trailed with smoke a mile into the sky, and blasting past the stands just a couple hundred feet off the runway, inverted of course.

Those dreams were dashed though when I learned that imperfect vision was a dis-qualifier. Imperfect vision ... hell, I wore Coke-bottle glasses as a kid (which were supplanted by contact lenses when I discovered girls, and eventually radial keratotomy).

Still, when the Blue Angels are in town, I get excited like a 10 year old - every single time.

This weekend they're the headliner at the Point Mugu Naval Airshow at Naval Base Ventura County, Point Mugu.

I rarely actually go to the air show any more because I can see much of the show from my house just a few miles away. And I've been spoiled - when my boy was in high school, his best friend's father was Commander of the base so we got to sit in the VIP section, right in front of the action, with food and beer galore.

But that special treat got trumped yesterday upon my return flight from visiting Mom.

As I was descending into Oxnard, Point Mugu Approached advised another aircraft in the area about a Blue Angels arrival. I assumed the aircraft was approaching the Naval base airfield.

Then lo and behold, off to my left as I passed through 3,000 feet, there they were! Diamond formation of six ships, smoke trailing, leveling off after a loop! I got the best seat in the house in Forty One Mike!

I fumbled for my phone camera and took a crummy shot - trying to see what I was shooting on the LCD screen of the phone with sun in my eyes, sunglasses on, and hand flying the approach ...

Mugu Approach called me up just as I took that crummy photo to advise of the Blue Angels presence off my 11 o'clock and that the ships would be breaking right to enter the Mugu pattern.

"In sight," was all I could muster over the radio - I was so excited. I really wanted to yell, "You're Damn Right they're in sight, Yahoo!"

Honestly, I don't really know why the Blue Angels get me so excited - I've seen them dozens of times. They've flown the exact same routine for years. I would say that the new perspective from 3,000 feet was it, but I feel the same excitement every time on the ground regardless of where I am.

Workers' compensation has a weird hold on me too - after more than 30 years one would think this would get routine and boring. But every day holds a new surprise.

For instance, the Missouri Court of Appeals this week ruled in Kolar v. First Student that a morbidly obese bus driver was entitled to benefits for an injury to his left leg that was caused by his uneven distribution of his substantial weight after he suffered an industrial injury to his right leg.

The court ruled the claimant was entitled to have that award enhanced by 12.5% to reflect the cumulative impact of his disabilities.

This might not seem to be a big deal, but the Kolar case is the first published case to address whether the "multiplicity factor" for cumulative disabilities survived the 2005 legislative reform that did away with liberal construction of the Missouri Workers' Compensation Act.

Missouri workers' compensation judges have historically had discretion to award a worker with multiple injuries compensation above the sum owed for each of his individual disabilities, if there is evidence that the combination of those disabilities exceeds the sum owed for the disabilities individually. The extent to which the award is enhanced is known as the "multiplicity factor."

Since there is no provision for such an enhancement within the text of the Workers' Compensation Act itself, attorneys in the state have been saying that strict construction of the act's provisions would not allow workers to have a "multiplicity factor" included in their awards of benefits.

They were wrong - at least for the moment. The court said that since the Legislature did not expressly terminate the use of "multiplicity factors" then they must have intended to keep that practice.

Missouri observed their work comp law fly a huge, mile high, diamond formation loop - and then break right to enter the landing pattern.

Some things change, some things stay the same - it's all thrilling to me.

Wednesday, September 23, 2015

Profit Before People

I wrote yesterday about reality and perception, yet we, the industry, continue to be our own worst enemies creating negative realities to match the negative perceptions.

The industry got a bee in its collective bonnet when ProPublica and OSHA issued reports and stories with anecdotes about how the workers' compensation system failed injured workers.

Countless injured workers who have dared to speak out publicly via forums, blogs, social media, television, radio and other media outlets, are castigated and marginalized by the industry as wacky complainers who don't have a life so they focus on claims.

Industry insiders are afraid to blow the whistle for fear of retribution, or worse.

Attorneys representing injured workers are vilified for taking advantage of the system's alleged "no fault" design to erode the protections afforded employers.

Our own governmental agencies tout statistics reflecting decreased claim frequency and severity, lowered medical costs, but improved outcomes, but anecdotes keep appearing challenging the rosy stats.

But, as we see in Kelly Tinsley vs. Vertis Communications; ACE USA/ESIS, the system is NOT balanced, is greatly skewed against injured workers and without representation people would die, victims of The System.

Tinsley had an admitted industrial injury to his neck, spine, neurogenic bowel, neurogenic bladder, internal organs and psyche employer as a machinist arising out of an incomplete C6 spinal cord injury on January 10, 2010.

After being hospitalized, Tinsley was released home, and started having active suicidal ideations. He began treatment with Dr. David Patterson through the Casa Colina Transitional Living Center Residential Program Post-Acute Physical Rehabilitation with One on One Supervision (whew!)

He attempted suicide on 8/31/2011 by carbon monoxide poisoning. When he failed to show for an appointment a friend checked on him and found him lying on the garage floor. He was airlifted to a hospital, and after three days of inpatient care was released home and thereafter admitted back to Casa Colina on 9/2/2011.

Eventually Tinsley was seen by a Panel Qualified Medical Examiner who opined that Tinsley's active suicidal ideation was real, was a problem, and that he should not be released back to the care of a family member because the suicide hazards could not be managed properly.

The claims adjuster requested that the Requests for Authorization for Casa Colina be submitted one month at a time. Dr. Patterson complied.

According to the Workers' Compensation Judge's report on reconsideration, "There was no conflict or disagreement between the applicant's primary treating physician, Dr. David Patterson and the Panel QME, Dr. Greils as to the reasonableness of the treatment prescribed and provided."

For whatever reason, the claims adjuster (who had been on the case from the outset according to the WCAB opinion) decided to submit the 9/28/2014 RFA to utilization review, without any of Dr. Greil's medical reports, his depositions, or the deposition of Dr. Patterson.

As you might guess, UR denied the treatment, and the claims adjuster stopped paying Casa Colina.

"The court found the failure of ESIS to send the relevant medical reports and depositions to the doctor performing the Utilization Review to be troubling. There are few cases where the issues of life and death are truly before us. This is one of those rare cases. In the 10/7/2014 Utilization Review, Dr. O'Brien refers to the Medical Treatment Utilization Schedule [MTUS] for neck and upper back complaints and treatment for chronic pain. Dr. O'Brien does not address the fact that the basis for the recommended one on one care is due to the opinion of his treating and evaluating physicians that he will kill himself if this care is not provided.

...

"Mr. Tinsley therefore continues to be a resident at Casa Colina although it is represented it was about to discharge him due to non-payment of his treatment provided since October 2014. No doctor has been able to find a better alternative..."

When ESIS stopped payting Casa Colina, treatment was paid through Tinsley's own funds.

The issue that really brought this case to the WCJ was not the egregious behavior of the claims adjuster and ESIS, but that they couldn't even follow The Law with respect to service and timeliness.

Listen, the law and regulations are SO stacked in favor of the payer community right now, a failure in procedure is inexcusable. If you can't get it right, then don't try...

"The WCJ correctly found that the UR was invalid because defendant did not show that it was timely communicated to Dr. Patterson...," the Board wrote. "The WCJ also properly relied upon the holding in Dubon II to award the treatment at issue because it s reasonable and supported by substantial medical evidence."

The failure in compassion and humanity in this case is beyond inexcusable and, frankly, nearly criminal.

The Board chastised ESIS and the claims adjuster for not even being able to follow procedures (procedures that were fomented mostly by the defense community in recent reforms) and then still trying to claim a defense against DOING THE RIGHT THING.

In a separate concurrence, Commissioner Sweeney hit upon the real issue: "However, it is important to note that there is no evidence in the record of any change in applicant's condition or circumstance that reasonably supports the initiation of UR to evaluate the ongoing treatment as (sic) Casa Colina that had been routinely approved and successfully provided for several years."

And, had the case been Commisioner Sweeney's to adjudge herself, she would have thrown the proverbial book at the defendants, "In this case, there is no evidence that defendant made any effort to reach an agreement on a care plan with applicant's treating physician before it terminated payments to Casa Colina. The absence of an agreed care plan to address the consequences of discontinuing inpatient care at Casa Colina as part of the UR could be considered a neglect or refusal to provide reasonable medical treatment [citations]."

Perception derived from reality: too often it seems the claims community would rather an injured worker DIE instead of paying for a lifetime of treatment because it is cheaper - the mighty dollar is, indeed, more important than human life in Corporate America.

The only logical conclusion I can draw is that the payer would rather Tinsley kill himself instead of having to deal with this claim, and its expense (reportedly $40,000 per month), for the rest of his, frankly, miserable life.

Does work comp have a bad image? You bet. This case demonstrates why. And frankly that image is deserved when this kind of behavior occurs.

I hope applicant's attorney takes the defendants to the cleaners on this case, and moreover, I hope that the emasculated Audit Unit imposes the harshest of the now castrated penalties on the payer.

Not that it will teach anyone a lesson.

You know why this world needs lawyers? Because there are still way too many who put profit before people.

My team at WorkCompCentral work really hard to highlight the good in workers' compensation.

Cases like this make communicating that message difficult.

A copy of the Opinion and Order Denying Defendant's Petition for Reconsideration is here.

*************

Post script from the applicant's attorney, Keith More:

The industry got a bee in its collective bonnet when ProPublica and OSHA issued reports and stories with anecdotes about how the workers' compensation system failed injured workers.

Countless injured workers who have dared to speak out publicly via forums, blogs, social media, television, radio and other media outlets, are castigated and marginalized by the industry as wacky complainers who don't have a life so they focus on claims.

|

| Poor Bowser... |

Industry insiders are afraid to blow the whistle for fear of retribution, or worse.

Attorneys representing injured workers are vilified for taking advantage of the system's alleged "no fault" design to erode the protections afforded employers.

Our own governmental agencies tout statistics reflecting decreased claim frequency and severity, lowered medical costs, but improved outcomes, but anecdotes keep appearing challenging the rosy stats.

But, as we see in Kelly Tinsley vs. Vertis Communications; ACE USA/ESIS, the system is NOT balanced, is greatly skewed against injured workers and without representation people would die, victims of The System.

Tinsley had an admitted industrial injury to his neck, spine, neurogenic bowel, neurogenic bladder, internal organs and psyche employer as a machinist arising out of an incomplete C6 spinal cord injury on January 10, 2010.

After being hospitalized, Tinsley was released home, and started having active suicidal ideations. He began treatment with Dr. David Patterson through the Casa Colina Transitional Living Center Residential Program Post-Acute Physical Rehabilitation with One on One Supervision (whew!)

He attempted suicide on 8/31/2011 by carbon monoxide poisoning. When he failed to show for an appointment a friend checked on him and found him lying on the garage floor. He was airlifted to a hospital, and after three days of inpatient care was released home and thereafter admitted back to Casa Colina on 9/2/2011.

Eventually Tinsley was seen by a Panel Qualified Medical Examiner who opined that Tinsley's active suicidal ideation was real, was a problem, and that he should not be released back to the care of a family member because the suicide hazards could not be managed properly.

The claims adjuster requested that the Requests for Authorization for Casa Colina be submitted one month at a time. Dr. Patterson complied.

According to the Workers' Compensation Judge's report on reconsideration, "There was no conflict or disagreement between the applicant's primary treating physician, Dr. David Patterson and the Panel QME, Dr. Greils as to the reasonableness of the treatment prescribed and provided."

For whatever reason, the claims adjuster (who had been on the case from the outset according to the WCAB opinion) decided to submit the 9/28/2014 RFA to utilization review, without any of Dr. Greil's medical reports, his depositions, or the deposition of Dr. Patterson.

As you might guess, UR denied the treatment, and the claims adjuster stopped paying Casa Colina.

"The court found the failure of ESIS to send the relevant medical reports and depositions to the doctor performing the Utilization Review to be troubling. There are few cases where the issues of life and death are truly before us. This is one of those rare cases. In the 10/7/2014 Utilization Review, Dr. O'Brien refers to the Medical Treatment Utilization Schedule [MTUS] for neck and upper back complaints and treatment for chronic pain. Dr. O'Brien does not address the fact that the basis for the recommended one on one care is due to the opinion of his treating and evaluating physicians that he will kill himself if this care is not provided.

...

"Mr. Tinsley therefore continues to be a resident at Casa Colina although it is represented it was about to discharge him due to non-payment of his treatment provided since October 2014. No doctor has been able to find a better alternative..."

When ESIS stopped payting Casa Colina, treatment was paid through Tinsley's own funds.

The issue that really brought this case to the WCJ was not the egregious behavior of the claims adjuster and ESIS, but that they couldn't even follow The Law with respect to service and timeliness.

Listen, the law and regulations are SO stacked in favor of the payer community right now, a failure in procedure is inexcusable. If you can't get it right, then don't try...

"The WCJ correctly found that the UR was invalid because defendant did not show that it was timely communicated to Dr. Patterson...," the Board wrote. "The WCJ also properly relied upon the holding in Dubon II to award the treatment at issue because it s reasonable and supported by substantial medical evidence."

The failure in compassion and humanity in this case is beyond inexcusable and, frankly, nearly criminal.

The Board chastised ESIS and the claims adjuster for not even being able to follow procedures (procedures that were fomented mostly by the defense community in recent reforms) and then still trying to claim a defense against DOING THE RIGHT THING.

In a separate concurrence, Commissioner Sweeney hit upon the real issue: "However, it is important to note that there is no evidence in the record of any change in applicant's condition or circumstance that reasonably supports the initiation of UR to evaluate the ongoing treatment as (sic) Casa Colina that had been routinely approved and successfully provided for several years."

And, had the case been Commisioner Sweeney's to adjudge herself, she would have thrown the proverbial book at the defendants, "In this case, there is no evidence that defendant made any effort to reach an agreement on a care plan with applicant's treating physician before it terminated payments to Casa Colina. The absence of an agreed care plan to address the consequences of discontinuing inpatient care at Casa Colina as part of the UR could be considered a neglect or refusal to provide reasonable medical treatment [citations]."

Perception derived from reality: too often it seems the claims community would rather an injured worker DIE instead of paying for a lifetime of treatment because it is cheaper - the mighty dollar is, indeed, more important than human life in Corporate America.

Does work comp have a bad image? You bet. This case demonstrates why. And frankly that image is deserved when this kind of behavior occurs.

I hope applicant's attorney takes the defendants to the cleaners on this case, and moreover, I hope that the emasculated Audit Unit imposes the harshest of the now castrated penalties on the payer.

Not that it will teach anyone a lesson.

You know why this world needs lawyers? Because there are still way too many who put profit before people.

My team at WorkCompCentral work really hard to highlight the good in workers' compensation.

Cases like this make communicating that message difficult.

A copy of the Opinion and Order Denying Defendant's Petition for Reconsideration is here.

*************

Post script from the applicant's attorney, Keith More:

Awesome - thank you for understanding the plight of the injured worker. Timeliness, REALLY !!! That is the only way I could get this to the Judge. Not the simple fact that the Labor Code and Rules and Regs REQUIRES the appropriate medical records be reviewed by a UR physician within the same specialty or area of practice. This is why Dubon II must be overturned. The WCAB found it "troubling" that the PQME report was not submitted for review or why the 2 volumes of the PQME's depositions were not sent by the adjuster for review, What about the FACT that the UR doctor chosen by Ace/Esis this time, was an internist who does not have an outside office and does not see patients for treatment purposes. Mr. Tinsley did not have an internal issue. Why and how could anyone in compliance with the law choose an INTERNIST for this review. It's not like the adjuster had not seen this request 28 days before. It's not like the adjuster did not see the same request 28 days before that. None of the other requests had been sent to an INTERNIST.

The request for medical care was not for chronic pain (the basis for the denial). Troubling is the best they, the WCAB could do since they overturned Dubon I. It's not troubling it's alarming. It's abusive. It's punitive. This system is called "Worker's Compensation" not "Insurance Profits"! Ace/Esis through its adjuster Cheryl Brownlee who we personally served to appear at trial has already told Casa Colina they will appeal the Decision.

Why not? Well, the WCAB while using strong language failed to issue sanctions on its own for the "troubling" behavior. "Every life is worth saving", a brave firefighter said after 9/11. Why not Kelly Tinsley, a 27 year dedicated employee of Vertis who was severely injured on the job.

Tuesday, September 22, 2015

Reality and Perception

There was a debate in one of the LinkedIn forums the other day, which I can't seem to find anymore, about "reality." A big part of the argument going around was about the difference between reality, and perception.

I differentiate the two only on the basis of perspective.

Perspective is everything.

Reality is an objective observation. Reality can be measured. It is either on or off. It's nemesis is fantasy.

Perception may encompass reality, just as much as it may encompass fantasy. Perception is a subjective observation. The experience is personal, and filtered through one's experiences, which may generate bias and opinion.

The subject of lien filings in California was, and continues to be, a sore one to vendors, payers, and the government.

SB 863 introduced radically different qualifications for making claims of lien against compensation cases, introducing filing and activation fees, along with alternative medical bill resolution processes.

The reason for these changes was the perception that liens were clogging the system, denying injured workers of dispute resolution services as a result, and costing the payer community untold millions of excess and unnecessary dollars.

The reality is that no one actually knew, or knows now, exactly how many liens there were, or are, how many actually end up before a workers' compensation judge in place of an injured worker's dispute, how many get settled, how much the value is in both gross and net numbers, and whether or not in fact (not perception) these liens clog the system.

We do know the quantity of liens actually filed and/or activated.

But everything else is anyone's guess.

Division of Workers' Compensation spokesman Peter Melton said in an email to WorkCompCentral on Friday the division doesn't know how many viable liens are in the system, because many have been negotiated out or sold to third parties.

And unless a lien claimant notifies the Workers' Compensation Appeals Board that a lien has been resolved, it will show up in the system even though the provider is no longer pursuing the claim.

The 2011 Lien Report by the Commission on Health and Safety and Workers' Compensation provides some information on the average amount claimed per lien. According to the report, the average amount claimed per medical lien was $7,774 based on a 2010 survey of claims adjusters.

The WCIRB in its November 2014 SB 863 Cost Monitoring Report said the average amount demanded for all liens in 2012 was $6,009. For 2013 and 2014, the average was $6,662. The WCIRB report did not break down average cost by lien claimant type.

These are all very nice numbers, and demonstrate the amorphous nature of the problem - in workers' compensation we tend to solve problems that we don't understand because our perceptions govern our actions, not reality.

The California lien issue hit a lot of emotional nerves.

Payers objected to "phantom liens" - claims that arise years after a case is closed because some entrepreneur purchased a book of receivables that may or may not have been previously resolved. Payers ultimately decide it's cheaper to throw money at the paper than to litigate and risk being ultimately liable anyhow. This engenders more of the same...

Vendors argued that payers don't take bill resolution seriously and lien claims are necessary to ensure payment at some point in time in the litigation.

Neither position is supported by fact, even though the state has had a computing system for 25 years that was originally designed to manage lien claims (the Electronic Data Exchange or "EDEX"). EDEX is still operational even though much of its function has been merged with the Electronic Adjudication Management System ("EAMS").

But for whatever reason, these systems cannot provide the division with precise numbers. We're left to conjecture based on some reasonable assumptions and assessments ... i.e, perception.

I'm not sure much of this matters in the end anyhow.

We're all in The System. The bottom line of our jobs, whether you're a vendor, a payer or the government, is to serve the two (and only two) intended beneficiaries - injured workers and employers.

We can't prevent accidents (they are called accidents for a reason, 'An unexpected event usually with negative and harmful consequences.'). We can't make everything (anything) perfect.

Our job is to make it better than it might have been had we not worked on it.

It's pretty simple. Accidents hurt people and they cost money. Our jobs are to minimize that impact.

Horace Mann, in 1859, said, "Be ashamed to die until you've scored a victory for Humanity."

I think he meant, "Leave the world a better place."

In other words, "Clean up your mess for the next person that occupies this space and leave a mint on the pillow."

I differentiate the two only on the basis of perspective.

Perspective is everything.

|

| Horace Mann |

Reality is an objective observation. Reality can be measured. It is either on or off. It's nemesis is fantasy.

Perception may encompass reality, just as much as it may encompass fantasy. Perception is a subjective observation. The experience is personal, and filtered through one's experiences, which may generate bias and opinion.

The subject of lien filings in California was, and continues to be, a sore one to vendors, payers, and the government.

SB 863 introduced radically different qualifications for making claims of lien against compensation cases, introducing filing and activation fees, along with alternative medical bill resolution processes.

The reason for these changes was the perception that liens were clogging the system, denying injured workers of dispute resolution services as a result, and costing the payer community untold millions of excess and unnecessary dollars.

The reality is that no one actually knew, or knows now, exactly how many liens there were, or are, how many actually end up before a workers' compensation judge in place of an injured worker's dispute, how many get settled, how much the value is in both gross and net numbers, and whether or not in fact (not perception) these liens clog the system.

We do know the quantity of liens actually filed and/or activated.

But everything else is anyone's guess.

Division of Workers' Compensation spokesman Peter Melton said in an email to WorkCompCentral on Friday the division doesn't know how many viable liens are in the system, because many have been negotiated out or sold to third parties.

And unless a lien claimant notifies the Workers' Compensation Appeals Board that a lien has been resolved, it will show up in the system even though the provider is no longer pursuing the claim.

The 2011 Lien Report by the Commission on Health and Safety and Workers' Compensation provides some information on the average amount claimed per lien. According to the report, the average amount claimed per medical lien was $7,774 based on a 2010 survey of claims adjusters.

The WCIRB in its November 2014 SB 863 Cost Monitoring Report said the average amount demanded for all liens in 2012 was $6,009. For 2013 and 2014, the average was $6,662. The WCIRB report did not break down average cost by lien claimant type.

These are all very nice numbers, and demonstrate the amorphous nature of the problem - in workers' compensation we tend to solve problems that we don't understand because our perceptions govern our actions, not reality.

The California lien issue hit a lot of emotional nerves.

Payers objected to "phantom liens" - claims that arise years after a case is closed because some entrepreneur purchased a book of receivables that may or may not have been previously resolved. Payers ultimately decide it's cheaper to throw money at the paper than to litigate and risk being ultimately liable anyhow. This engenders more of the same...

Vendors argued that payers don't take bill resolution seriously and lien claims are necessary to ensure payment at some point in time in the litigation.

Neither position is supported by fact, even though the state has had a computing system for 25 years that was originally designed to manage lien claims (the Electronic Data Exchange or "EDEX"). EDEX is still operational even though much of its function has been merged with the Electronic Adjudication Management System ("EAMS").

But for whatever reason, these systems cannot provide the division with precise numbers. We're left to conjecture based on some reasonable assumptions and assessments ... i.e, perception.

I'm not sure much of this matters in the end anyhow.

We're all in The System. The bottom line of our jobs, whether you're a vendor, a payer or the government, is to serve the two (and only two) intended beneficiaries - injured workers and employers.

We can't prevent accidents (they are called accidents for a reason, 'An unexpected event usually with negative and harmful consequences.'). We can't make everything (anything) perfect.

Our job is to make it better than it might have been had we not worked on it.

It's pretty simple. Accidents hurt people and they cost money. Our jobs are to minimize that impact.

Horace Mann, in 1859, said, "Be ashamed to die until you've scored a victory for Humanity."

I think he meant, "Leave the world a better place."

In other words, "Clean up your mess for the next person that occupies this space and leave a mint on the pillow."

That should be the only reality that matters.

Monday, September 21, 2015

Stay On The Game

There's an immutable truth about two wheels - eventually you will go down.

Riding motorcycles involves a higher level of risk than other "ordinary" daily activities, so the level of risk management is also heightened.

After a risk event has occurred, then the task evolves from risk management to event assessment, then short term corrective activity, and eventually long term adjustment.

Hopefully, along these phases, we learn something to a) increase risk management skills and b) improve post event procedures.

Through my 46 years of motorcycling adventure, I've improved my risk management skills considerably, and have also increased my knowledge and understanding of post event procedures.

Alas, I tested those skills and knowledge on Saturday. Fortunately, all 46 years of learning paid off.

For instance, not long ago I recognized that my riding clothes were not suitable for the type of riding I most often engage in (canyon roads in Malibu), so I upgraded to an Alpinestar full leather two piece riding suit. I got a great deal on it, so it passed my wife's value test (sliding scale: the more safety provided the more I can spend, but if I get a "bargain" then it's like an 'Ebay instant buy' approval - no discussion needed!).

It was sunny and clear. In the canyons probably in the mid-90s. The roads weren't busy.

My favorite first run is up Deer Creek Canyon - the views at the ridge top, where it turns to Pacific View Drive, sweep from the Pacific Ocean on the right, to the beautiful red rock of Boney Mountain on the left.

After the ridge the road turns into Cotharin Road, and then intersects Yerba Buena.

Normally I would go north on Yerba Buena towards Boney Mountain. But I knew it would be over 100 at the top, so I decided to stay at the lower elevations and instead of left at Yerba Buena, I turned right to head down to Pacific Coast Highway.

I love Yerba Buena Road. It's tight, twisty, and relatively good pavement on that south-bound leg (going up to Boney Mountain the road is in dire need of repair).

So down Yerba Buena Road I went, pitching The Sewing Machine (2011 Honda CBR250R) left to right and right to left, diving into corners, scrubbing those tires, and having The Time of My Life.

Ah, but a moment of inattention resulted in a test of my risk management skills.

I wasn't riding particularly assertively as I entered a tight right hand drop away 180 degree corner about half way down Yerba Buena (40 miles into my ride) - ... my demise.

It was slow motion. I clearly felt the slide start, and I countered with my best corrective action - a little more counter-steering, a touch more throttle, no brakes - alas, too little too late.

TMS slid out at about 30 MPH - a low-side on the right. I held on, as I have learned over those 46 years, to maintain as much control over machine and man as possible. Clutch in, throttle still in hand - after we stopped sliding, I noted that we had swiveled nearly 120 degrees so the front of the bike was facing up hill.

Dang it!

Post event assessment ensued.

I quickly remounted, engine still running, and throttled out of the roadway, back up a few feet to identify what the heck happened and that's when I noticed that the right footpeg on TSM was missing.

The Alpinestar suit proved an excellent risk management system - no bruises, no cuts, no rash: no insult to my body whatsoever.

The only damage, other than the broken foot peg, was scraps on the tail pipe heat guard, scratches on the right mirror, a bent brake pedal and the scuff marks on the leathers.

Otherwise, very little damage, and if I didn't tell my wife she might not notice...

Inspection of the road didn't reveal anything abnormal. I didn't notice any loose dirt. The asphalt appeared normal. My conclusion was that I was just a hair off my game, and payment was extracted.

But clearly, the "temporary disability" of a missing footpeg meant the balance of my ride (Mulholland Highway, Latigo Canyon Road, Decker Canyon Road, among others) would be cancelled - time to limp home with my right foot using the rear, passenger, footrest for support.

Back home I straightened the brake lever with a wrench, cleaned up the hash marks on the mirror with a file, and ordered up a surplus footpeg on Ebay for $11.00, tax and shipping included.

The Alpinestar leathers are now officially broken in...

The thing about risk management is that one never knows whether the techniques implemented work until a risk event occurs. And then it's too late to make adjustments - you can only learn from that risk event to make adjustments for future possibilities, which of course you won't know whether the adjustments are successful until the following risk event.

And the risks come from all sorts of different angles. In my case there's the risk of falling in the first place, but that is the major, precipitating event to other risk events.

But once a risk event happens, once an injury occurs, once a claim is made, managing the risk is no longer applicable. It's too late. The risk happened!

Risk management in the work place is about ensuring safe practices so a work injury or claim does not occur.

Risk management on the other hand is not about managing the work comp claim because, as I said above, the injury or claim occurred because of the failure in risk management in the first place.

What happens after a risk event, after the claim is made or injury incurred, now becomes claim management - or if we were following the lessons from Monday's teachings, people management.

Injured workers are not a risk anymore, they are real - risk management already failed because there was an injury or illness, or a claim of such. Using risk management techniques on injured workers fails them, fails the employer, fails the system.

The skills and techniques are different.

After the risk event it's time to manage the person, not the risk.

I think its noteworthy that the preeminent organization for risk managers includes in its title, insurance. For not only does the professional risk manager assess and remediate potential risks, but part of the equation is ensuring mitigation of a risk event with insurance coverage.

And once the risk event occurs the risk manager becomes the insurance manager to ensure the folks to whom the risk was transferred do their jobs in the post event setting. The top risk managers recognize that the next stage has occurred and people management becomes paramount.

Medical costs can go up, claim frequency can go down, indemnity severity might go up - at the end of the day, risk management first retards the probability of a risk event, but then moves into managing the claims response.

I said that after a risk event occurs the risk manager learns and makes adjustments.

After nearly 20 years of marriage, I have learned and have made adjustments, particularly in my post risk event people management techniques.

When I returned home I told my wife that I was really happy with my Alpinestar leather suit and that it "worked perfectly."

She was ecstatic at first, but frowned when I told her of my first person testing. She smiled again after I noted that there was no damage to body, or soul, and that TSM had only about $11 worth of damage.

Next weekend I'll be just a little more attentive to my riding, and stay on my game.

Riding motorcycles involves a higher level of risk than other "ordinary" daily activities, so the level of risk management is also heightened.

After a risk event has occurred, then the task evolves from risk management to event assessment, then short term corrective activity, and eventually long term adjustment.

Hopefully, along these phases, we learn something to a) increase risk management skills and b) improve post event procedures.

Through my 46 years of motorcycling adventure, I've improved my risk management skills considerably, and have also increased my knowledge and understanding of post event procedures.

Alas, I tested those skills and knowledge on Saturday. Fortunately, all 46 years of learning paid off.

For instance, not long ago I recognized that my riding clothes were not suitable for the type of riding I most often engage in (canyon roads in Malibu), so I upgraded to an Alpinestar full leather two piece riding suit. I got a great deal on it, so it passed my wife's value test (sliding scale: the more safety provided the more I can spend, but if I get a "bargain" then it's like an 'Ebay instant buy' approval - no discussion needed!).

It was sunny and clear. In the canyons probably in the mid-90s. The roads weren't busy.

My favorite first run is up Deer Creek Canyon - the views at the ridge top, where it turns to Pacific View Drive, sweep from the Pacific Ocean on the right, to the beautiful red rock of Boney Mountain on the left.

After the ridge the road turns into Cotharin Road, and then intersects Yerba Buena.

Normally I would go north on Yerba Buena towards Boney Mountain. But I knew it would be over 100 at the top, so I decided to stay at the lower elevations and instead of left at Yerba Buena, I turned right to head down to Pacific Coast Highway.

I love Yerba Buena Road. It's tight, twisty, and relatively good pavement on that south-bound leg (going up to Boney Mountain the road is in dire need of repair).

So down Yerba Buena Road I went, pitching The Sewing Machine (2011 Honda CBR250R) left to right and right to left, diving into corners, scrubbing those tires, and having The Time of My Life.

Ah, but a moment of inattention resulted in a test of my risk management skills.

I wasn't riding particularly assertively as I entered a tight right hand drop away 180 degree corner about half way down Yerba Buena (40 miles into my ride) - ... my demise.

It was slow motion. I clearly felt the slide start, and I countered with my best corrective action - a little more counter-steering, a touch more throttle, no brakes - alas, too little too late.

TMS slid out at about 30 MPH - a low-side on the right. I held on, as I have learned over those 46 years, to maintain as much control over machine and man as possible. Clutch in, throttle still in hand - after we stopped sliding, I noted that we had swiveled nearly 120 degrees so the front of the bike was facing up hill.

Dang it!

Post event assessment ensued.

I quickly remounted, engine still running, and throttled out of the roadway, back up a few feet to identify what the heck happened and that's when I noticed that the right footpeg on TSM was missing.

The Alpinestar suit proved an excellent risk management system - no bruises, no cuts, no rash: no insult to my body whatsoever.

The only damage, other than the broken foot peg, was scraps on the tail pipe heat guard, scratches on the right mirror, a bent brake pedal and the scuff marks on the leathers.

Otherwise, very little damage, and if I didn't tell my wife she might not notice...

Inspection of the road didn't reveal anything abnormal. I didn't notice any loose dirt. The asphalt appeared normal. My conclusion was that I was just a hair off my game, and payment was extracted.

Back home I straightened the brake lever with a wrench, cleaned up the hash marks on the mirror with a file, and ordered up a surplus footpeg on Ebay for $11.00, tax and shipping included.

The Alpinestar leathers are now officially broken in...

The thing about risk management is that one never knows whether the techniques implemented work until a risk event occurs. And then it's too late to make adjustments - you can only learn from that risk event to make adjustments for future possibilities, which of course you won't know whether the adjustments are successful until the following risk event.

And the risks come from all sorts of different angles. In my case there's the risk of falling in the first place, but that is the major, precipitating event to other risk events.

But once a risk event happens, once an injury occurs, once a claim is made, managing the risk is no longer applicable. It's too late. The risk happened!

Risk management in the work place is about ensuring safe practices so a work injury or claim does not occur.

Risk management on the other hand is not about managing the work comp claim because, as I said above, the injury or claim occurred because of the failure in risk management in the first place.

What happens after a risk event, after the claim is made or injury incurred, now becomes claim management - or if we were following the lessons from Monday's teachings, people management.

Injured workers are not a risk anymore, they are real - risk management already failed because there was an injury or illness, or a claim of such. Using risk management techniques on injured workers fails them, fails the employer, fails the system.

The skills and techniques are different.

After the risk event it's time to manage the person, not the risk.

I think its noteworthy that the preeminent organization for risk managers includes in its title, insurance. For not only does the professional risk manager assess and remediate potential risks, but part of the equation is ensuring mitigation of a risk event with insurance coverage.

And once the risk event occurs the risk manager becomes the insurance manager to ensure the folks to whom the risk was transferred do their jobs in the post event setting. The top risk managers recognize that the next stage has occurred and people management becomes paramount.

Medical costs can go up, claim frequency can go down, indemnity severity might go up - at the end of the day, risk management first retards the probability of a risk event, but then moves into managing the claims response.

I said that after a risk event occurs the risk manager learns and makes adjustments.

After nearly 20 years of marriage, I have learned and have made adjustments, particularly in my post risk event people management techniques.

When I returned home I told my wife that I was really happy with my Alpinestar leather suit and that it "worked perfectly."

She was ecstatic at first, but frowned when I told her of my first person testing. She smiled again after I noted that there was no damage to body, or soul, and that TSM had only about $11 worth of damage.

Next weekend I'll be just a little more attentive to my riding, and stay on my game.

Friday, September 18, 2015

Guilty Without Charge

The other day I wrote about the fear in the workers' compensation industry to blow the whistle on wrong doers.

Many readers acknowledged that fact and I got several telephone calls and comments/emails that there is a culture of retaliation in workers' compensation against do-gooders.

And everyone thinks that they will be singled out, believing that the problem is only in the state or jurisdiction in which they participate.

It's not. What happens in one state is rampant, and unfortunately, standard, practice in probably every state. I think I've had enough phone calls on the topic from different people in completely different jurisdictions to confidently state that.

One trick that happens to be in vogue across state lines is the use of third party networks to obfuscate the true medical treatment bill, as I mentioned Wednesday.

Here's how it works:

A medical provider renders services to an injured worker and submits his or her bill to the medical provider network.

The MPN has a contract with XYZ claims department to manage the medical billing and is paid on a percentage of "cost savings" basis.

The MPN then manipulates the original medical billing, recoding and otherwise changing the bill to inflate it and then "discount" it.

I was told of one specific incident where a neurologist had received authorization from the claims examiner for a $10,000 procedure, but then the MPN interceded. The neurologist performed the procedure and submitted his bill to the MPN, and got paid a bit less because the MPN negotiated the fee down.

The MPN then recoded and manipulated the bill up to reflect $24,000 in services, and submitted the reformatted, new, billing to the carrier, which then paid the bill without question.

The allegation is that the MPN not only falsely represents what the charges were, but falsely represents what the actual savings are, and gets away with it by kicking back a "fee" to someone with a white collar high in the chain of command at the claims department.

Somehow the neurologist got a hold of the billings and documentation to support this - but won't divulge it to reveal identities because he gets too much business from the MPN and carrier.

If this scenario is happening on one state, it's happening in every state where there are MPNs, and in fact my bet is this kind of activity happens in nearly any case where cost controls are delegated to private enterprise.

So why doesn't someone do something about this? How can such illegal behavior continue on for so long without law enforcement interception?

This behavior was identified long ago - in 1961 President Dwight Eisenhower warned the American public of the dangers of the military-industrial complex: the policy and monetary relationships which exist between legislators, national armed forces, and the arms industry that supports them. The temptation to take advantage of the back door obfuscation for ill gotten profit is too great, particularly if the company is reporting to public investors.

I recall growing up news about all the big defense contractors getting wrapped up in investigations, hearings, fines and penalties, and monetary damages, as dirty relationships were uncovered. Nobody ever admits wrongdoing, but everybody pays a little more money to make the story go away.

In the case of workers' compensation, we don't have any big investigations going on that I'm aware of, and if there were then they are probably best kept secret at this time lest interference occur.

But it's not the fact that these shameful actions are occurring, or aren't stopped, which causes me consternation.

Its the fact that the fear of reprisal is so great that even those with the strongest of ethics, morals and sense of right-doing won't come forth with their information and identify people and companies.

Sure, we can all wait for law enforcement to jump in, but by then it's too late, if at all. The harm to the public has been done. The profiteers have had sufficient time to launder their gains and hide the evidence.

And ultimately the behavior is reinforced with what amounts to slaps on the wrists.

Many readers acknowledged that fact and I got several telephone calls and comments/emails that there is a culture of retaliation in workers' compensation against do-gooders.

And everyone thinks that they will be singled out, believing that the problem is only in the state or jurisdiction in which they participate.

It's not. What happens in one state is rampant, and unfortunately, standard, practice in probably every state. I think I've had enough phone calls on the topic from different people in completely different jurisdictions to confidently state that.

|

| Bowzer knows it when he sniffs it... |

One trick that happens to be in vogue across state lines is the use of third party networks to obfuscate the true medical treatment bill, as I mentioned Wednesday.

Here's how it works:

A medical provider renders services to an injured worker and submits his or her bill to the medical provider network.

The MPN has a contract with XYZ claims department to manage the medical billing and is paid on a percentage of "cost savings" basis.

The MPN then manipulates the original medical billing, recoding and otherwise changing the bill to inflate it and then "discount" it.

I was told of one specific incident where a neurologist had received authorization from the claims examiner for a $10,000 procedure, but then the MPN interceded. The neurologist performed the procedure and submitted his bill to the MPN, and got paid a bit less because the MPN negotiated the fee down.

The MPN then recoded and manipulated the bill up to reflect $24,000 in services, and submitted the reformatted, new, billing to the carrier, which then paid the bill without question.

The allegation is that the MPN not only falsely represents what the charges were, but falsely represents what the actual savings are, and gets away with it by kicking back a "fee" to someone with a white collar high in the chain of command at the claims department.

Somehow the neurologist got a hold of the billings and documentation to support this - but won't divulge it to reveal identities because he gets too much business from the MPN and carrier.

If this scenario is happening on one state, it's happening in every state where there are MPNs, and in fact my bet is this kind of activity happens in nearly any case where cost controls are delegated to private enterprise.

So why doesn't someone do something about this? How can such illegal behavior continue on for so long without law enforcement interception?

This behavior was identified long ago - in 1961 President Dwight Eisenhower warned the American public of the dangers of the military-industrial complex: the policy and monetary relationships which exist between legislators, national armed forces, and the arms industry that supports them. The temptation to take advantage of the back door obfuscation for ill gotten profit is too great, particularly if the company is reporting to public investors.

I recall growing up news about all the big defense contractors getting wrapped up in investigations, hearings, fines and penalties, and monetary damages, as dirty relationships were uncovered. Nobody ever admits wrongdoing, but everybody pays a little more money to make the story go away.

In the case of workers' compensation, we don't have any big investigations going on that I'm aware of, and if there were then they are probably best kept secret at this time lest interference occur.

But it's not the fact that these shameful actions are occurring, or aren't stopped, which causes me consternation.

Its the fact that the fear of reprisal is so great that even those with the strongest of ethics, morals and sense of right-doing won't come forth with their information and identify people and companies.

Sure, we can all wait for law enforcement to jump in, but by then it's too late, if at all. The harm to the public has been done. The profiteers have had sufficient time to launder their gains and hide the evidence.

And ultimately the behavior is reinforced with what amounts to slaps on the wrists.

The industry is good at distracting us, and the public, from this white collar crime: there are fraud enforcement divisions that get their funding from the insurance industry, there are fraud think tank organizations that get their funding from the insurance industry, and press releases of injured worker fraud get lots of airplay despite the fact that the dollar amounts involved are de minimis in comparison to all other forms of fraud.

Nothing is more effective in curbing bad behavior than the court of public opinion - but until identification and documentation is provided then we're all, each and every one of us, just as guilty of condoning fraud as the criminals committing it are.

Nothing is more effective in curbing bad behavior than the court of public opinion - but until identification and documentation is provided then we're all, each and every one of us, just as guilty of condoning fraud as the criminals committing it are.

Thursday, September 17, 2015

Uwayday

The top local television news story Tuesday night was about Kelly Soo Park, who was acquitted in the murder of Juliana Redding in 2013. She was back in court facing new charges.

Park was named in an indictment, along with 14 other people, of falsifying documents in an attempt to protect Dr. Munir Uwaydah, who owned the now defunct Frontline Medical Associates in San Fernando, CA.

Park's bail was set at $18.5 million.

The real story though, that local news didn't report fully, is about Uwayday.

Uwayday had been on the lam for years. He fled the country in May or June of 2010, when Park was arrested and accused of killing Redding at his request.

Uwayday was allegedly arrested in Germany and is facing extradition on various charges of wrongdoing in workers' compensation cases.

According to one of two grand jury indictments, handed down Feb. 25 and unsealed Tuesday, business entities associated with Uwaydah and Frontline Medical co-owner Paul Turley billed insurance companies more than $150 million between February 2011 and February 2015.

The entities, which include Firstline Health, Golden State Pharmaceuticals, South Bay Surgical and Spine Institute, U.S. Health and Orthopedics, Controlled Health Management and Ventura County Collections, also have liens for the same period seeking more than $150 million.

Turley was arrested on Sunday. His bail was set at $21.5 million.

Prosecutors say Uwaydah and Frontline Medical paid attorneys and marketers up to $10,000 a month for illegal patient referrals, an arrangement known as "capping." There were bonuses for patients who were surgical candidates.

In addition, Uwayday is accused of deceiving two dozen patients into believing he was doing surgery on them when in fact a physician's assistant who never attended medical school, actually performed the procedures.

That assistant, Peter Nelson, was booked into a Los Angeles county detention facility Monday with bail set at $21.5 million.

Jane Robison, a spokeswoman for the Los Angeles County District Attorney's Office, told WorkCompCentral she can't comment on whether Uwaydah is still a person of interest in Redding's murder or any other aspect of the case.

There are a number of other people named but not accused in the indictments who are still active in the Southern California workers' compensation scene.

The indictment naming Uwaydah as a defendant is here.

The indictment for his alleged accomplices is here.

Redding was killed in 2008. Uwayday was romantically connected to Redding, and she was the daughter of a pharmacist whose business relationship with Uwayday had soured.

Park was named in an indictment, along with 14 other people, of falsifying documents in an attempt to protect Dr. Munir Uwaydah, who owned the now defunct Frontline Medical Associates in San Fernando, CA.

Park's bail was set at $18.5 million.

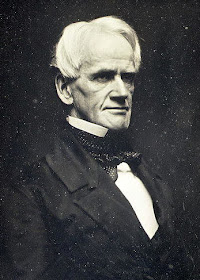

|

| Uwayday |

The real story though, that local news didn't report fully, is about Uwayday.

Uwayday had been on the lam for years. He fled the country in May or June of 2010, when Park was arrested and accused of killing Redding at his request.

Uwayday was allegedly arrested in Germany and is facing extradition on various charges of wrongdoing in workers' compensation cases.

According to one of two grand jury indictments, handed down Feb. 25 and unsealed Tuesday, business entities associated with Uwaydah and Frontline Medical co-owner Paul Turley billed insurance companies more than $150 million between February 2011 and February 2015.

The entities, which include Firstline Health, Golden State Pharmaceuticals, South Bay Surgical and Spine Institute, U.S. Health and Orthopedics, Controlled Health Management and Ventura County Collections, also have liens for the same period seeking more than $150 million.

Turley was arrested on Sunday. His bail was set at $21.5 million.